PETRONAS CHEMICALS GROUP BHD (19 Feb 2025)

Year 2024 (1 January 2024 – 31 December 2024)

1st quarter summary (1 January 2024 – 31 March 2024)

The company’s performance is improving, particularly in terms of profitability, operational efficiency, and specialty chemicals growth. However, challenges such as lower plant utilization, subdued prices for fertilizers and methanol, and weaker demand in some markets limit the pace of recovery.

2nd quarter summary (1 April 2024 – 30 June 2024)

The company’s performance is gradually improving, as indicated by higher plant utilization, revenue growth, and profitability gains year-on-year. The Fertilizers and Methanol and Specialty segments are driving this improvement, showing strong recovery. However, challenges remain in the Olefins and Derivatives segment, where profitability is constrained by higher costs and soft market demand.

3rd quarter summary (1 July 2024 – 30 September 2024)

**Stagnant to Declining Performance**

Operationally Improving: Higher plant utilization and production volumes reflect better operational performance. Profitability Challenges: Unrealized forex losses, higher finance costs, and lower spreads have led to significant declines in EBITDA and PAT. Adjusted results show stability but are not enough to offset the broader financial pressures. Segmental Variability: While F&M and Specialties show signs of recovery, O&D remains under pressure from external factors. Overall Assessment: The company’s performance is stagnant to declining, with operational improvements offset by external financial headwinds.

According to THE EDGE MALAYSIA (5 NOV 2024), key factors behind PCHEM's share price decline are:

Weaker Expected Results: Anticipation of negative profit guidance due to expected foreign exchange losses, higher depreciation charges from Pengerang Integrated Complex (PIC), and lower average selling prices (ASPs) for the olefins and derivatives segment weighed on investor sentiment.

Operational Challenges: Planned plant turnarounds in the second half of 2024 led to temporary shutdowns, reducing production volumes and increasing maintenance-related costs.

Losses at PIC: Larger-than-expected losses at PIC, driven by higher operating costs and rising depreciation expenses, raised concerns about its profitability and impact on group performance.

Market Sentiment and Institutional Selling: Heavy selling by local institutions and negative analyst ratings (majority "Sell" or "Hold") further pressured the stock, with trading volumes significantly exceeding averages.

Industry and Macro Challenges: Lower ASPs due to weak downstream demand and oversupply, coupled with macroeconomic uncertainties, added to the pessimism surrounding the stock.

Liquidity

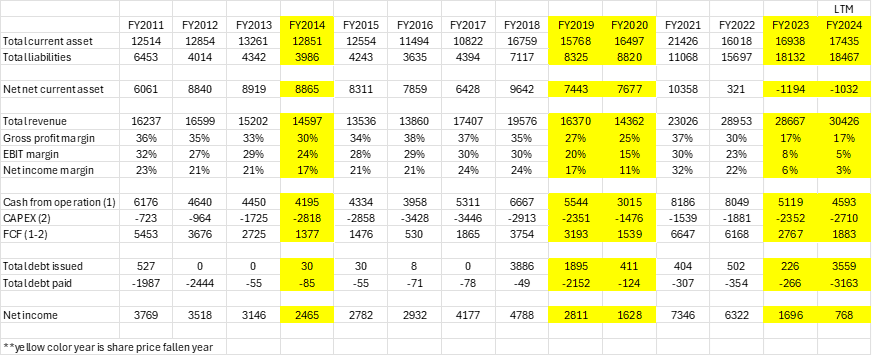

The company’s net current assets grew consistently from 2011 to 2021, reflecting strong profitability and efficient operations. However, this streak hit a speed bump in 2022 due to the hefty acquisition of Perstorp Group—a bold move, but one that came with a sharp drop in liquidity. A case of “go big or go home,” perhaps?

Profitability

Revenue has been on an overall upward trend, with a few hiccups in 2014, 2019, and 2020—likely reminders of the business cycle's inevitable swings. However, the gross profit margin, EBIT, and net income margins hit rock bottom in 2023 and 2024. While the company is no stranger to cyclical downturns, this level of margin contraction feels like hitting every branch of the cyclical tree on the way down. (The cyclical risk/nature of the business are discussed below).

Cash Flow

Operational cash flow has historically outpaced reported net income—a comforting metric for any investor. The company hasn't been one to rely heavily on external refinancing, showing discipline in managing its balance sheet. That said, the notable spike in debt raised and repaid in 2024 suggests the business may have needed a bit of a lifeline.

Valuation & Investment Case

Despite the doom-and-gloom margins of 2023–2024, the market seems to have overreacted. With a market capitalization (P) of RM37 billion, the stock is trading at historically low levels, presenting an intriguing opportunity. Let’s break it down:

Worst-case (2020 earnings of RM1,628 million): An E/P ratio of 4.4%, which already beats stashing cash under the mattress.

Normal-case (2015–2016 average earnings of RM2,800 million): An E/P ratio of 7.5%, a solid return that exceeds the growth of total assets, equity, and revenue (historically around 5–6%).

Best-case (2017–2018 average earnings of RM4,500 million): An E/P ratio of 12%, which would make even the most sceptical investor smile.

The Verdict

Comparing these E/P ratios to the company’s historical compounded growth rates for total assets (6%), equity (5%), and revenue (5%), even the normal earnings scenario provides a more attractive return than the company’s long-term growth trajectory. In essence, you’re getting this company at a bargain price, assuming earnings can return to their historical mean.

The bottom line? You’re not just buying into a business—you’re buying into a company that has weathered downturns before and, with some patience, could offer excellent returns. It’s like snagging a designer jacket on clearance: the fundamentals are still high quality, and you're just waiting for it to come back in style.

Is the downtrend temporary or structural?

Mostly Temporary:

Issues like economic slowdown, feedstock price volatility, unplanned shutdowns, and PIC delays are short- to medium-term challenges that PCG is actively addressing. As global conditions stabilize and operational efficiencies improve, these risks should diminish.

Partially Structural:

Margin compression, global overcapacity, intense competition from China, and the cyclical nature of the petrochemical industry are structural issues. These will require long-term strategic adjustments, such as investing in specialty chemicals, improving cost efficiencies, and enhancing sustainability initiatives, to remain competitive.

Investing in a company trading at its all-time low (such as COVID-era levels) can present a compelling opportunity, especially if it has a solid balance sheet and cash flow. Below is a breakdown of favourable and unfavourable factors to consider before making an investment decision in this company:

Favourable Factors

Solid Financials

Strong Balance Sheet: The company has low gearing and robust liquidity, ensuring it can weather challenging economic conditions without significant financial strain.

Consistent Cash Flow: Steady cash generation even during downturns allows the company to fund operations, maintain dividends, and invest in growth projects without heavy reliance on debt.

Attractive Valuation

Historically Low Price: The stock is trading at all-time low levels, which could imply undervaluation. If the market has overly discounted the company due to short-term challenges, it presents a value-buying opportunity.

Cyclical Recovery Potential

The petrochemical industry is cyclical, and the current downcycle is temporary. A recovery in global demand could lead to improved margins and earnings growth.

The anticipated upturn in global GDP growth and reduction in inflationary pressures could reignite chemical demand across key sectors (e.g., automotive, agriculture, personal care).

Strategic Initiatives for Growth

Specialty Chemicals Expansion: Investments in higher-margin specialty products (e.g., through Perstorp and BRB integration) position the company to diversify away from commoditized chemicals. Shift toward specialty chemicals is crucial because it reduces exposure to commodity cycles, provides higher & more stable margins, competes in niche markets where pricing power is stronger

Sustainability Focus: Projects like the advanced chemical recycling plant and Project Air (sustainable methanol) align with long-term trends toward sustainability and could drive growth in ESG-focused markets.

5. Pengerang Integrated Complex (PIC) Commercialization

· The massive PIC facility is set to increase PCHEM’s production capacity significantly. Despite delays in ramp-up, the pre- commencement sales in 2023 already contributed to revenue. Once fully operational, PIC will reduce import dependence and increase integration efficiency. When PIC reaches optimal utilization, it could expand EBITDA margins and increase production efficiency.

Unfavourable Factors

Short-Term Margin Pressure

The combination of high feedstock costs, elevated energy prices, and soft chemical prices is likely to keep margins compressed in the near term.

Weak demand in key regions (e.g., Europe, China) and industry overcapacity are unlikely to resolve immediately, limiting short-term profitability.

Exposure to prolonged cyclical risks

The petrochemical industry is inherently cyclical, and the company remains exposed to macroeconomic fluctuations, geopolitical tensions, and energy price volatility.

The timing of the recovery is uncertain, and prolonged economic stagnation could delay improvements in demand and pricing.

Intense Competition

Increased competition from low-cost Chinese producers in global markets, particularly in Europe, puts pressure on pricing and market share.

Without significant differentiation or cost advantages, the company may struggle to maintain competitiveness in certain regions.

Operational Risks

Unplanned shutdowns, delays in PIC commissioning, and logistical disruptions (e.g., Panama Canal congestion, Suez Canal volatility) could further impact production and sales volumes.

While efforts to improve plant reliability are ongoing, these operational risks remain a concern.

Investor Confidence and Sentiment

Despite solid fundamentals, the current low valuation reflects investor concerns about near-term challenges, such as compressed earnings and uncertain recovery timelines.

If management fails to deliver on key strategic initiatives (e.g., specialty chemicals ramp-up, sustainability projects), market confidence may erode further.

ESG and Regulatory Risks

Heightened focus on sustainability and stricter regulations in key markets (e.g., Europe) could increase compliance costs and pressure margins.

Geopolitical conflicts (e.g., Russia-Ukraine) and environmental policies (e.g., carbon taxes) may also pose long-term risks to the petrochemical industry.

Conclusion

If you are a long-term investor with confidence in the company’s ability to navigate the current downcycle, execute its strategic initiatives, and capitalize on an eventual industry recovery, this could be an attractive opportunity to invest at a discounted valuation. However, for a short-term investor, the near-term risks (e.g., margin compression, weak demand) may outweigh the potential rewards until clearer signs of recovery emerge.