KESM Industries Berhad (part 1)

Business overview

Automotive Semiconductor Testing & Burn-In

The company specializes in burn-in and testing services for semiconductor devices, with a core emphasis on automotive chips (e.g., microcontrollers, sensors, and ADAS-related components). Automotive manufacturers typically require higher reliability and zero-defect standards, which the company caters to with stringent quality processes and advanced equipment.

Capital-Intensive Operations & Equipment Investments

A significant share of the company’s assets is dedicated to property, plant, and equipment (PPE). Recent financial statements show PPE composing around 35% of total assets, reflecting the need for continuous upgrades to meet evolving semiconductor technology (e.g., for ADAS, EV powertrain).

Secondary EMS Segment

Beyond testing services, the company at times engages in Electronic Manufacturing Services (EMS). However, EMS revenues have been scaling back in favor of higher-value burn-in/test opportunities, especially in the automotive segment.

Recent Developments

Revenue Softness but Operational Resilience

Revenues have hovered in the RM240 million range over the past few years—below the ~RM300 million peak—reflecting stagnant demand in automotive/semiconductor cycles. However, the company has avoided sustained heavy losses, often operating at or near break-even.

Latest Quarter Dip

According to the 1QFY2025 data, revenue declined about 17% year-on-year (from RM63.5 million to RM52.8 million), pushing the company into a loss before tax of RM5.0 million. This came alongside lower volumes for automotive chip testing.

Impairment Assessments & Key Risks

The auditors’ report highlights impairment of PPE and investments in subsidiaries as areas requiring careful judgement (e.g., using discounted cash flow or fair value models). No major impairments were reported.

Increasing Demand for EV/ADAS

Even amid revenue stagnation, the company continues to invest in specialized equipment for the next wave of automotive electronics (EV power management, ADAS sensors). This positions it for an eventual upturn in chip volumes as EV and advanced driver-assistance systems gain further traction.

Steady Dividends, Strong Balance Sheet

Despite subdued earnings, the company regularly pays out dividends. Coupled with its large net cash buffer, this underscores management’s historically prudent financial approach—a factor that has helped maintain the firm’s resilience in downcycles.

(1) Historical analysis

From January 2015 to December 2017, the stock price increased by 700%

Key reasons include:

In 2015, the company made a power move—acquiring the remaining testing equity from Sunright Limited like grabbing the last slice of pizza at a party. This strategic consolidation not only boosted its market capital but also supercharged its testing services for the automotive sector. With the launch of TDBI (Test During Burn-In) that slashed failure rates by 30%, they set out to meet the ultra-strict "zero defect" standards of the auto world, paving the way for growth and leaving competitors wondering if they should have brought a backup slice.

Rolling into 2016, the company shifted into high gear with record revenue growth and nearly doubled net profits, proving that efficiency is the best kind of horsepower. They fine-tuned their production processes, improved cycle times, and shared cost savings like handing out free air fresheners at a car wash. Their strategic partnerships with half of the top automotive chipmakers placed them firmly in the cool club of semiconductor testing, where the only thing more impressive than their numbers was their ability to drive down costs without missing a beat.

By 2017, the company wasn’t just cruising—it was full-throttle racing ahead. With a hefty RM140.2 million investment in new equipment, they expanded capacity to process over 1.7 billion semiconductor devices, all while rolling out real-time quality tracking tools and an intelligent OEE system that boosted tester throughput by 19%. This tech upgrade not only gave customers 24/7 remote quality access (because who doesn’t like to keep an eye on things?) but also cemented their role as the go-to tester for L3+ autonomous chips. With automotive revenue soaring to about 70% of total sales and a market projected to grow at 39% CAGR, the company clearly decided to ride the auto tailwind straight into the fast lane of profitability.

SUMMARY

In the 2015–2017 period, one of the key factors behind the company's improved sales and earnings was its strategic pivot toward the automotive semiconductor segment. This move allowed the company to "ride the tailwind" of increasing demand in the auto sector—driven by rising chip content in vehicles for applications like engine control, ADAS, and infotainment. The acquisition that consolidated its testing services further bolstered its position, while substantial capital investments and operational improvements enabled it to capitalize on the growing opportunities in this high-growth segment.

From January 2018 to December 2019, the stock price dropped by 50%

In 2018, it seemed like the company’s supply chain decided to go on a strict diet—materials were scarce, poor yields for new devices, and expansion plans got delayed faster than a commuter train on a rainy day. Even though revenue tried to put on a brave face, net profits took an 11% hit, largely thanks to new machinery that depreciated quicker than a smartphone’s battery life and soaring operating costs. To add insult to injury, global trade jitters made customers tighten their belts (and inventories), while capital investments took a nosedive, with PPE dropping by RM31.8 million—almost as if the company was skipping leg day in its growth workout.

Then came 2019, when things really hit the fan. Revenue dropped 12%, and profit margins were squashed, profit before tax plummeted by a whopping 78%, leaving earnings per share looking more like a discount clearance tag. The rough ride was fuelled by a cocktail of the U.S.–China trade war, a slump in car demand in China, and a generally weak semiconductor industry. As if that wasn’t enough, raw material and consumable costs surged by 34%, turning the cost structure into a veritable roller coaster of expenses. With macroeconomic headwinds and cutthroat pricing battles adding to the chaos, market confidence took a significant hit—proving that sometimes, even a well-oiled machine can sputter when the fuel is subpar.

SUMMARY

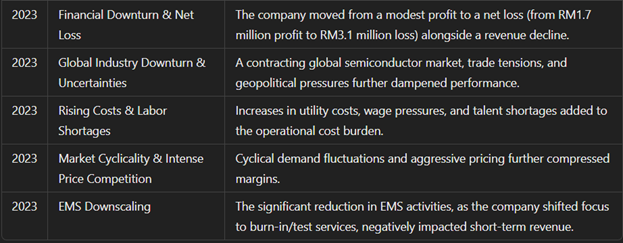

From Covid era to 2023, stock price remained stagnant